san bernardino tax collector property taxes

Do not send cash. Mikulski began her position as the ATC Chief Deputy Tax Collector in November 2021.

San Bernardino County S Auditor Controller Treasurer Tax Collector Where Do My Property Tax Dollars Go

The value assessed on the property is subject to the ad.

. The median property tax on a 31900000 house is 334950 in the United States. This calculator can only provide you with a rough estimate of your tax liabilities based on. How much is property tax on a 300000 house in California.

The first installment is due on November 1. Change my address on file. Include Block and Lot number on memo line.

The second installment is due on February 1. She holds a BS. Look up public official records.

The Assessors new Parcel Access application provides. Initial base year value. San Bernardino County Tax Collector.

San Bernardino County collects on average 063 of a propertys assessed fair market value as property tax. She joined ATC in 2005 and held various positions in the Internal Audits and Property Tax Divisions prior to promoting to her current post. The canceled checkmoney order stub serves as your receipt.

Office of the Treasurer Tax Collector. Enter Any Address to See the Current Owner Property Taxes Other Current Records. The median property tax on a 31900000 house is 200970 in San Bernardino County.

If a property has an assessed home value of 300000 the annual property tax for it would be 3440 based on the national average. We are located at 747 Club View Dr Big Bear Lake CA 92315. Degree in Business Administration with a concentration in Accounting from California State University San.

House barn or shed. The record will not state what the improvement is ie. The 20212022 Annual Secured property tax roll is closed.

The market value of the property has grown to 250000. He has also served as Assistant ATC. This convenient service uses the latest technology to provide a secure way to bid on tax-defaulted property.

This must be extrapolated from the. With easy access to property information and auction results you can research properties and enter bids from anywhere in the world. The average effective property tax rate in San Bernardino County is 081.

Ad Enter Any Address Receive a Comprehensive Property Report. Degree in Business Administration from the. She most recently worked in healthcare finance and has extensive knowledge in accounting.

Unclaimed Tax Refund Search. Find All The Record Information You Need Here. San Bernardino County has one of the highest median property taxes in the United States and is ranked 445th of the 3143 counties in order of.

San Bernardino Treasurer-Tax Collector mails out original Secured property tax bills in October every year. See Results in Minutes. Members of the San Bernardino County Sheriffs Department including Sheriff Shannon Dicus top right visit the Inland Empire Ronald McDonald House in Loma Linda.

Web-hosted tax sale auctions are part of. Report Fraud Waste. John Johnson joined the San Bernardino County Treasury Division in 2004 and was appointed Chief Deputy Treasurer in 2008.

You may purchase duplicate tax bills for 1 at any Tax Collectors office. 571-L Instructions Filing Options and Forms Due Date April 1Penalty Date May 7 If May 7th falls on a weekend or legal holiday the property statement may be filed or mailed and postmarked on the next business day. The San Bernardino County Assessor assesses all property in Victorville on July 1 of each year.

Prior to his County service Mr. Establishing an assessed value for all properties subject to taxation. 1st Fl San Bernardino CA 92415 909 387-8308 Assessed Valuation.

Center 1600 Pacific Hwy Room 162 San Diego CA 92101. And applying all legal exemptions. He holds a BS.

Johnson spent 15 years in the private sector as a registered securities representative. What is a supplemental tax bill. Treasurer-Tax Collector San Diego County Admin.

Listing all assessed values on the assessment roll. The median property tax on a 31900000 house is 236060 in California. San Bernardino County Website.

Look up property information. The median property tax in San Bernardino County California is 1997 per year for a home worth the median value of 319000. The final payment deadline is April 10.

If the property is reassessed at a higher value than the old assessed value. The supplemental assessment reflects the difference between the new assessed value and the old or prior assessed value. She is a California-licensed CPA with over 18 years of professional experience in accounting auditing and management.

Please note only our downtown branch office can accept cash payments. SAP Center of Excellence. Linda Santillano has served as Property Tax Division chief since October 2017.

A 10 penalty will be added if not paid as of 500 pm. In year 1 the subject property was purchased transferred for 200000 and the Assessor enrolled that amount as the base year value. The Assessor is responsible for locating describing and identifying ownership of all property within the County of San Bernardino.

The San Bernardino County Historical Archive has Assessor LotParcel Books from 1895 to approximately 1950. Questions regarding property tax payments should be directed to. State law requires the Assessor to reappraise property upon a change of ownership or new construction.

Chief Deputy Tax Collector. Pay my property taxes Tax Collector Website. Make checkmoney order payable to SF Tax Collector.

The San Bernardino County Assessor provides several options for filing Business Property Statements 571-L. 222 West Hospitality Lane San Bernardino CA 92415 Assessor Services. These books can provide a key in determining the age of a structure by the year an improvement appears on the property.

Unsure Of The Value Of Your Property. The maximum amount the property could be assessed under proposition 13 is 204000 200000 2. Welcome to the San Bernardino County online auction website.

909 387-8307 Recorder-Clerk Services. The final payment deadline is December 10.

Atc Mason Clarifies Tax Deadlines San Bernardino County Auditor Controller Treasurer Tax Collector Atc Ensen Mason Today Pointed Out That The Recent Extension Of The Personal Income Tax Filing Deadline By The Federal And California

Online Auction Of More Than 2 500 Tax Defaulted Properties Begins May 17 County Of San Bernardino Countywire

San Bernardino County Auditor Controller Treasurer Tax Collector Facebook

California Public Records Public Records California Public

San Bernardino County Property Tax Assessor And Tax Collector

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

San Bernardino County S Auditor Controller Treasurer Tax Collector Where Do My Property Tax Dollars Go

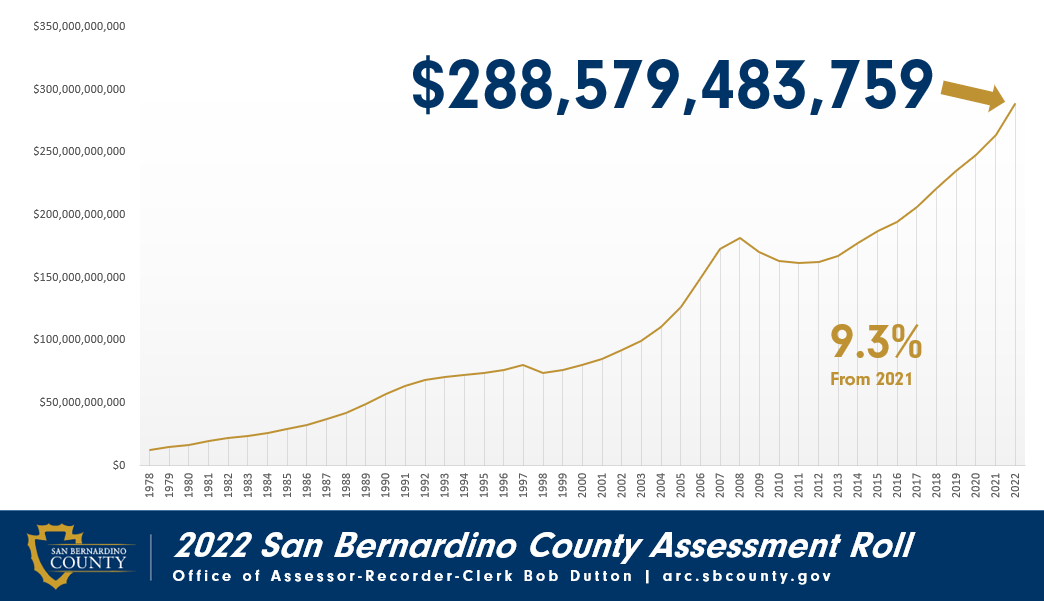

2021 San Bernardino County Property Assessment Roll Surpasses Quarter Of A Trillion In Value San Bernardino County Assessor Recorder Clerk

San Bernardino County S Auditor Controller Treasurer Tax Collector Where Do My Property Tax Dollars Go

Property Tax How To Calculate Local Considerations

2022 San Bernardino County Assessment Roll Shows Historic All Time High 288 Billion In Value San Bernardino County Assessor Recorder Clerk

The 7 Things Solar Panel Makers Don T Want You To Know Solar Roof Solar Panels Solar Panel Cost

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire

San Bernardino County Auditor Controller Treasurer Tax Collector Facebook

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire